Understanding IRS Form 4549: A Comprehensive Guide

Form 4549, issued by the IRS, details proposed changes following an audit; understanding its contents is crucial for taxpayers navigating potential adjustments to their returns.

Reviewing Form 4549 alongside your audit report is essential, as it explains the IRS’s findings and proposed alterations, referencing relevant tax tables and instructions.

Taxpayers should carefully examine Form 4549, as it outlines their rights and options, including agreement, disagreement, and the possibility of an appeals conference with the IRS.

What is Form 4549?

Form 4549, officially titled “Report of Income Tax Examination Changes,” is a crucial document issued by the Internal Revenue Service (IRS) to taxpayers following a tax audit. This form isn’t a request for payment; rather, it serves as a formal notification outlining proposed adjustments to a previously filed tax return.

Essentially, Form 4549 communicates the IRS’s findings after scrutinizing your tax documents. It details specific changes the agency intends to make to your reported income, deductions, credits, or other tax liabilities. Receiving this form signifies that the IRS is questioning aspects of your original return and proposes alterations based on their examination.

The form itself includes a detailed explanation of these proposed changes, referencing specific tax laws and regulations. It’s vital to understand that receiving Form 4549 doesn’t automatically mean you owe additional taxes; it initiates a process allowing you to respond and potentially challenge the IRS’s determinations. Careful review and understanding of the form’s contents are paramount for navigating the next steps.

Purpose of Form 4549: Report of Income Tax Examination Changes

The primary purpose of Form 4549 is to formally communicate the results of a tax examination conducted by the IRS to the taxpayer. It meticulously details any proposed changes to the taxpayer’s original tax return, stemming from the audit process. This isn’t simply a bill; it’s a comprehensive report outlining the IRS’s reasoning and calculations.

Specifically, Form 4549 clarifies discrepancies identified during the audit, such as unreported income, disallowed deductions, or incorrect tax credits. It provides a clear breakdown of how the IRS arrived at its proposed adjustments, referencing relevant tax laws and regulations.

Furthermore, the form serves as a crucial starting point for taxpayer response. It informs taxpayers of their rights to agree with the changes, disagree and pursue an appeal, or request an appeals conference. Essentially, Form 4549 initiates a dialogue, ensuring taxpayers have the opportunity to understand and address the IRS’s findings before any final assessment is made.

When You Will Receive Form 4549

You will receive Form 4549, “Report of Income Tax Examination Changes,” after the IRS has completed its review of your tax return during an audit. This doesn’t happen immediately upon audit initiation; rather, it’s issued towards the conclusion of the examination process. Expect it following the IRS’s internal assessment and determination of proposed adjustments.

Typically, the IRS will send Form 4549 via mail, accompanied by supporting documentation, including a detailed explanation of the changes and the rationale behind them. The timeframe for receiving the form can vary depending on the complexity of the audit and the IRS’s workload, but it generally occurs within a reasonable period after the examination concludes.

It’s crucial to retain all documentation received with Form 4549, as it forms the basis for your response. Be vigilant in checking your mail, especially if you’ve been notified of an audit, to ensure timely receipt and review of this important document from the IRS;

Decoding the Information on Form 4549

Form 4549 details proposed tax adjustments; carefully review each section, understanding the IRS’s findings and referenced tax tables for accurate interpretation.

Key Sections of the Form

Form 4549, “Report of Income Tax Examination Changes,” is structured to clearly communicate the IRS’s proposed adjustments. The form begins with identifying information, including your name, address, and the tax year under review. A crucial section details the specific changes the IRS intends to make, outlining the original amount reported, the IRS’s proposed adjustment, and the resulting difference.

You’ll find a section referencing the IRS tax table used to determine the adjustments, often linked to specific income levels and filing statuses. The form also includes explanations for each change, referencing relevant tax laws or regulations. Pay close attention to the “Consent to Assessment and Collection” area, as signing it signifies agreement with the proposed changes.

Furthermore, Form 4549 will outline your rights as a taxpayer, including the right to appeal the IRS’s decision. It’s vital to understand each section thoroughly before proceeding, as it directly impacts your tax liability. Detailed instructions for completing and understanding the form are available on the IRS website.

Understanding Proposed Changes

When reviewing Form 4549, carefully analyze the proposed changes detailed by the IRS. Each adjustment will be presented with the original amount you reported, the IRS’s proposed change, and the resulting difference in tax liability. The IRS must provide a clear explanation for each adjustment, referencing specific tax laws or regulations supporting their findings.

Don’t simply accept the proposed changes at face value. Compare the IRS’s reasoning with your own records and supporting documentation. If you disagree with an adjustment, identify the specific reason for your disagreement. The IRS tax table referenced on the form provides context for how income levels impact tax calculations.

Understanding these proposed changes is crucial before signing the “Consent to Assessment and Collection” section. Consult the official instructions for Form 4549 and consider seeking professional tax advice if you find the adjustments complex or unclear. Thorough review ensures you’re making an informed decision.

Taxpayer Options After Receiving Form 4549

Upon receiving Form 4549, taxpayers have several options. You can agree with the proposed changes by signing the consent section, effectively accepting the adjustments and any resulting tax liability. However, carefully consider this before signing!

If you disagree with any proposed changes, you have the right to appeal. This initiates a formal process to challenge the IRS’s findings. The instructions for Form 4549 detail how to formally disagree and request an appeals conference.

Requesting an appeals conference allows you to present your case to an independent IRS Appeals Officer. This officer can review your case and potentially negotiate a resolution. Remember, you have appeal rights, and exercising them doesn’t necessarily mean further penalties. Consult IRS resources and potentially a tax professional to understand your best course of action.

Responding to Form 4549: Your Rights and Options

Form 4549 presents taxpayers with crucial rights, including agreement with changes, formal appeals, and requesting a conference to discuss findings with the IRS.

Agreeing with the Proposed Changes

If you concur with the adjustments outlined on Form 4549, signifying agreement is a straightforward process, but requires careful attention to detail. You must sign and date the form, explicitly indicating your consent to the proposed changes.

Returning the signed Form 4549 to the IRS promptly finalizes the audit adjustments. This acceptance signifies you acknowledge the revised tax liability and agree to pay any additional tax due, including any associated penalties and interest.

However, be absolutely certain you understand and agree with all proposed changes before signing. Consider reviewing your audit report alongside Form 4549 to ensure clarity. The IRS may accept faxed signatures on Form 4549-E, but verify current guidelines.

Remember, agreeing to the changes waives your right to further appeal the decision. Therefore, thorough review and understanding are paramount before providing your consent. Consulting with a tax professional is always advisable.

Disagreeing with the Proposed Changes: The Appeals Process

Should you disagree with the adjustments detailed on Form 4549, you have the right to challenge them through the IRS Appeals process. This initiates a formal review of the audit findings by an independent function within the IRS.

To begin, clearly indicate your disagreement on Form 4549 and articulate the specific reasons for your objection. Supporting documentation bolstering your position is crucial. You retain the right to representation during this process; a tax professional can be invaluable.

The Appeals process offers an opportunity to present your case and potentially negotiate a resolution. It’s less adversarial than court, focusing on factual review and reasonable compromise. However, timely action is vital; deadlines apply.

Failing to respond or missing deadlines may result in the IRS proceeding with the proposed changes. Understanding your rights and diligently pursuing the Appeals process is essential when contesting Form 4549 adjustments.

Requesting an Appeals Conference

If you’ve disagreed with the proposed changes on Form 4549 and wish to discuss the matter further, formally requesting an Appeals Conference is your next step. This allows a direct discussion with an Appeals Officer, an independent IRS representative.

To request a conference, follow the instructions provided on Form 4549 itself. Typically, this involves submitting a written request outlining the specific issues you wish to address and why you believe the IRS’s findings are incorrect.

Be prepared to present supporting documentation and a clear explanation of your position; You have the right to be represented by a qualified tax professional during the conference. The Appeals Officer will review your case and attempt to reach a mutually agreeable resolution.

Remember, requesting a conference doesn’t guarantee a different outcome, but it provides a valuable opportunity to present your case directly and potentially negotiate a favorable settlement.

Form 4549 and the Tax Audit Process

Form 4549 arrives after an audit, detailing proposed tax return changes; carefully review it alongside your audit report for complete IRS findings.

The Role of Form 4549 in a Tax Audit

Form 4549 plays a pivotal role as the official communication from the IRS following a tax audit, serving as a formal notification of proposed adjustments to your tax return.

It isn’t simply a notice of changes, but a detailed report outlining the IRS’s specific findings, the rationale behind them, and the resulting impact on your tax liability.

Receiving this form signifies the conclusion of the initial examination phase of the audit, transitioning the process to a review and response period for the taxpayer.

The IRS utilizes Form 4549 to clearly articulate the discrepancies identified during the audit, referencing specific items on your original return and providing supporting documentation.

Understanding the information presented on Form 4549 is paramount, as it forms the basis for your subsequent actions, whether agreeing with the changes or pursuing further recourse.

Essentially, Form 4549 is the bridge between the audit examination and the taxpayer’s opportunity to respond and resolve any outstanding issues with the IRS.

Reviewing Your Audit Report Alongside Form 4549

A thorough review of your audit report in conjunction with Form 4549 is absolutely critical for a comprehensive understanding of the IRS’s proposed adjustments.

The audit report provides the detailed findings that led to the changes outlined on Form 4549, offering context and supporting evidence for each proposed alteration.

Carefully compare the items listed on Form 4549 with the corresponding entries in your original tax return and the audit report to identify any discrepancies or misunderstandings.

Pay close attention to the IRS’s explanations for each change, ensuring you understand the reasoning behind their assessment and the relevant tax law applied.

Cross-referencing these documents allows you to accurately assess the impact of the proposed changes on your overall tax liability and make informed decisions.

Don’t hesitate to consult the Form 4549 instructions and related resources to clarify any unclear points or seek professional guidance if needed.

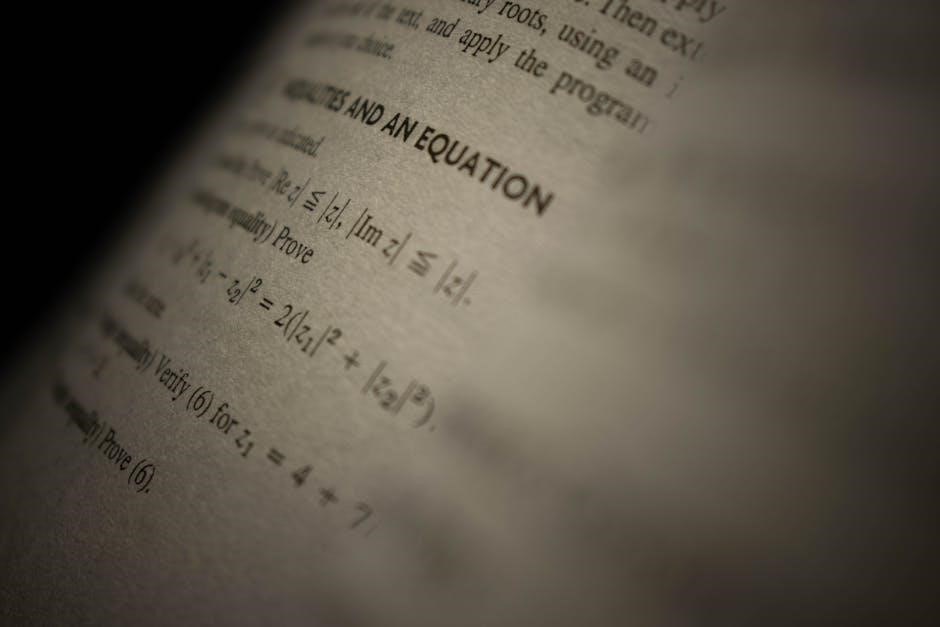

Understanding the IRS Tax Table Referenced in Form 4549

Form 4549 often references an IRS tax table, typically for the year under audit, which displays tax amounts based on taxable income and filing status.

This table is crucial for verifying the IRS’s calculations and understanding how they arrived at the proposed changes to your tax liability.

The table categorizes income levels and corresponding tax rates for single, married filing jointly, and other filing statuses, providing a clear framework for tax computation.

Carefully locate the tax table referenced on your Form 4549 and compare your income and filing status to determine the correct tax amount.

Ensure the IRS applied the correct tax rates and brackets based on your specific circumstances, as errors can occur during the audit process.

Refer to the official Form 4549 instructions and related IRS publications for detailed guidance on interpreting the tax table and verifying calculations.

Specific Instructions and Resources

IRS provides detailed Form 4549 instructions online, alongside resources for taxpayers facing audits, including guidance on Form 1040, Form W-9, and appeals processes.

Where to Find Official Form 4549 Instructions

Finding official guidance for Form 4549 is paramount for accurate understanding and response. The Internal Revenue Service (IRS) website is the primary source for the most current and comprehensive instructions. Taxpayers can directly access these resources through the IRS’s official publications portal, typically found within the “Forms & Publications” section.

Specifically, searching for “Form 4549 instructions” on IRS.gov will lead you to the relevant PDF document detailing each section of the form, explaining the required information, and outlining procedures for responding to proposed changes. These instructions often include examples and clarifications to aid in comprehension.

Furthermore, the IRS frequently links to related forms and publications, such as Form 1040 instructions, which may provide additional context. It’s crucial to utilize the official IRS resources to ensure compliance and avoid potential errors when addressing Form 4549-related matters. Always verify you are using the most recent version of the instructions.

IRS Resources for Taxpayers Facing Audits

The IRS provides several resources to assist taxpayers navigating the audit process and responding to Form 4549. The Taxpayer Advocate Service (TAS) offers independent help to those experiencing tax problems they haven’t been able to resolve with the IRS. TAS can intervene if a taxpayer is facing significant hardship.

IRS.gov features a dedicated “Audits” section with FAQs, guides, and publications explaining audit procedures, taxpayer rights, and options for resolving disputes. The IRS also offers free tax assistance through Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs, though these primarily focus on tax preparation, they can offer general guidance.

For specific questions about Form 4549 and proposed changes, taxpayers can contact the IRS directly via phone or mail. The IRS website provides contact information and details on how to reach the appropriate department. Utilizing these resources empowers taxpayers to understand their rights and effectively address audit-related concerns.

Form 4549 and Related Forms (Form 1040, Form W-9)

Form 4549 doesn’t exist in isolation; it’s intrinsically linked to other core tax forms. Primarily, it relates to your original Form 1040, the U.S. Individual Income Tax Return. The IRS uses Form 4549 to communicate proposed adjustments to the information reported on your Form 1040 after an audit.

Form W-9, Request for Taxpayer Identification Number and Certification, may also be relevant if the audit concerns income reported by a third party. The IRS might use information from a Form W-9 to verify income discrepancies identified during the audit process.

Understanding how changes on Form 4549 impact your Form 1040 is crucial. Reviewing the instructions for both forms, alongside your audit report, ensures you grasp the proposed adjustments and your options for responding. Correctly interpreting these connections is vital for a successful resolution.

Important Considerations

The IRS accepts faxed signatures on Form 4549-E, streamlining the process; however, taxpayers should be aware of consent to assessment and collection stipulations.

Faxed Signatures and Form 4549-E

Form 4549-E serves as a crucial component when responding to the IRS regarding proposed changes outlined in Form 4549, particularly concerning income tax examination adjustments.

A significant convenience offered by the IRS is the acceptance of faxed signatures on Form 4549-E, simplifying the process for taxpayers who prefer not to utilize traditional mail or electronic signature methods.

This flexibility allows for a quicker response to the IRS, potentially expediting the resolution of any discrepancies identified during the tax examination process. However, it’s vital to ensure the fax transmission is clear and legible to avoid any processing delays.

Taxpayers should retain a copy of the fax confirmation as proof of submission. Utilizing Form 4549-E with a faxed signature is a valid method for acknowledging and addressing the proposed changes, offering a streamlined approach to tax compliance.

Consent to Assessment and Collection

The “Consent to Assessment and Collection” section on Form 4549-E represents a critical decision point for taxpayers facing proposed adjustments from the IRS following a tax audit.

By signing this section, taxpayers explicitly waive their right to appeal the IRS’s findings and agree to the assessed tax, penalties, and interest without further administrative or judicial review.

Essentially, it’s an acknowledgement that you do not wish to contest the changes proposed by the IRS, streamlining the collection process. Carefully consider this choice, as it’s generally irreversible.

If you disagree with the proposed changes, or wish to explore options like an appeals conference, do not sign this section. Seeking professional tax advice is highly recommended before making this determination, ensuring you fully understand the implications of consenting to assessment and collection.